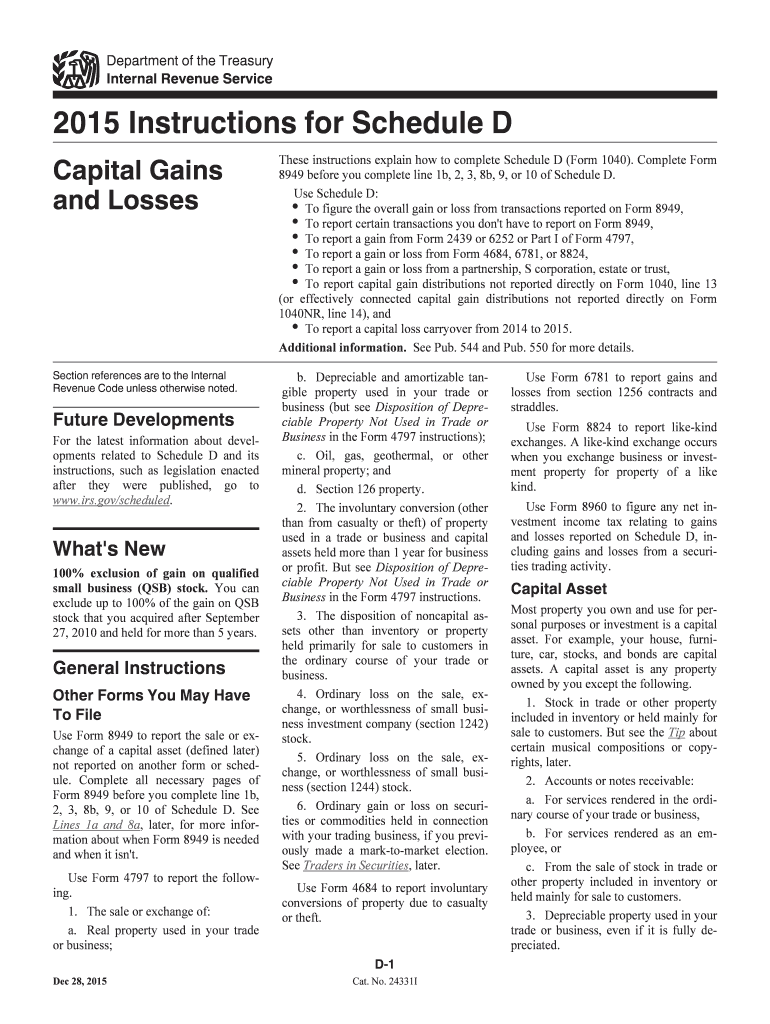

2025 Schedule D Instructions - IRS Schedule D Instructions, **to determine your gains and losses, you'll need to subtract the basis of the asset from the sales price. These instructions explain how to complete schedule d (form 1041). For information on how to elect to use these special.

IRS Schedule D Instructions, **to determine your gains and losses, you'll need to subtract the basis of the asset from the sales price.

2025 2025 Instructions And William Avery, It is used to help you calculate their capital gains or losses, and the amount of.

IRS Schedule D Instructions Capital Gains And Losses, The cy 2025 updates include the following:.

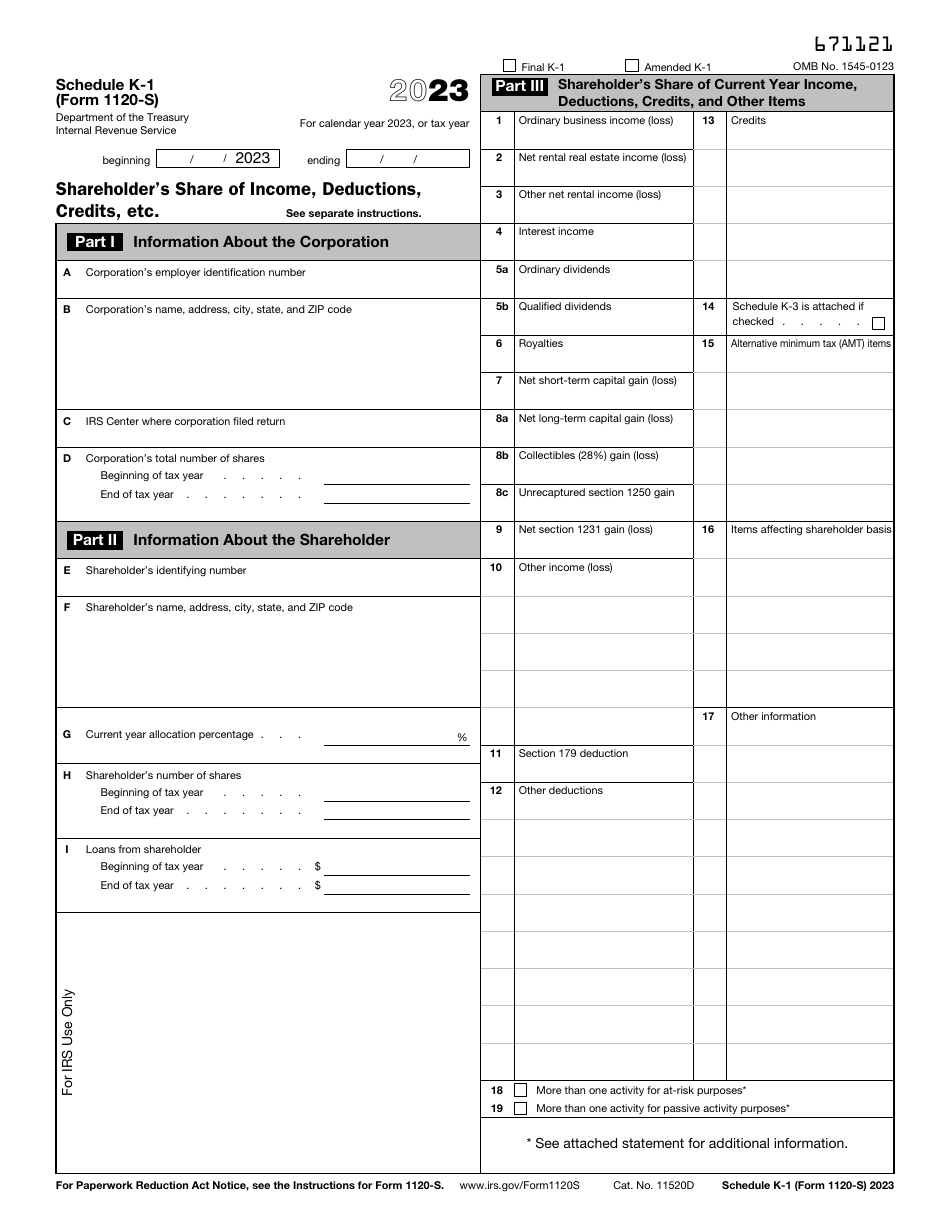

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online, **determine your gains and losses:

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)

IRS Schedule D Instructions, Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts.

Irs Schedule D Instructions 2025 Mary Starla, **to determine your gains and losses, you'll need to subtract the basis of the asset from the sales price.

2025 Instructions For Schedule D Sam Leslie, If the result is a.

2025 2025 Forms And Instructions Synonym Jennifer Wright, Capital assets include personal items like stocks, bonds, homes, cars, artwork, collectibles, and cryptocurrency.

2025 Schedule D Instructions. The overall gain or loss from transactions reported on form 8949, sales and other dispositions of capital assets. **determine your gains and losses:

Fillable Online 1995 Instructions 1120S (Schedule D). Instructions for, The overall gain or loss from transactions reported on form 8949, sales and other dispositions of capital assets.