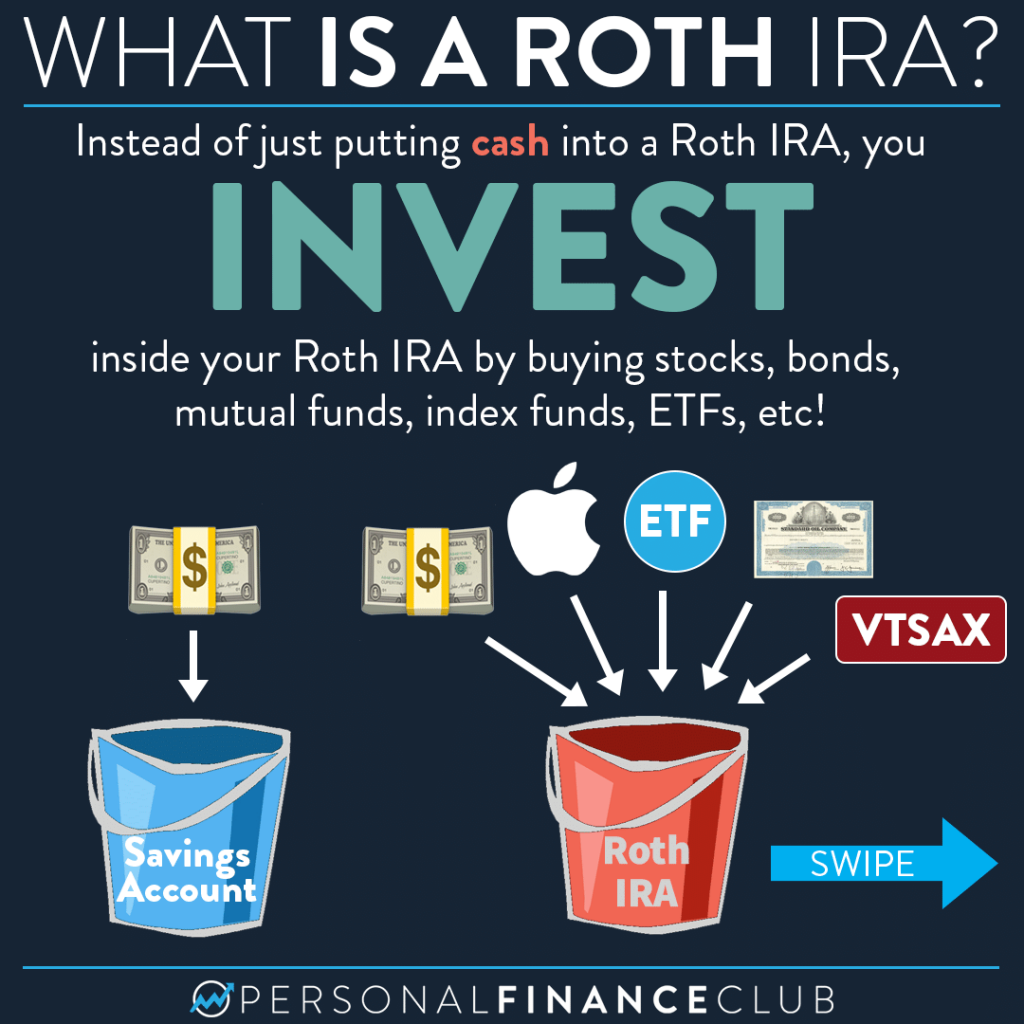

Roth Ira Limits 2025 Married Filing Jointly And - Roth Ira Limits 2025 Married Filing Jointly And. If your agi is $240,000 or. Married couples filing jointly with adjusted gross incomes up to $76,500. Roth Limits 2025 Married Filing Joint Drusi Isadora, Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on.

Roth Ira Limits 2025 Married Filing Jointly And. If your agi is $240,000 or. Married couples filing jointly with adjusted gross incomes up to $76,500.

Roth Ira Contribution Limits 2025 For Married Bidget Hilliary, Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced.

Roth Ira Contribution Limits 2025 Married Filing Jointly Per Person, The roth ira contribution limit for 2025 is $7,000 in 2025 ($8,000 if age 50 or older).

Maximum Roth Ira Contribution 2025 Married Dasi Timmie, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

Ira Limits 2025 Married Filing Jointly Married Dorie Geralda, 2025 roth ira income limits.

You’re married filing jointly or a qualifying widow(er) with an agi of. 2025 roth ira income limits.

Married Filing Jointly Roth Limits 2025 Una Lindsey, If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the.

Roth Ira Limits Married Filing Jointly 2025 Kassi Matilda, If your agi is $240,000 or.

Roth Ira Limits Married Filing Jointly 2025 Kassi Matilda, Here are the 2025 roth ira income limits based on your modified adjusted gross income and tax filing status:

Roth Ira Limits 2025 … Vanny Jaquelyn, If your 2025 modified adjusted gross income (modified agi) is greater than $146,000 for single taxpayers, or $230,000 if you’re married and filing jointly, your 2025.